The Benefits

Many healthcare providers today realize that the small group of doctors in 1899 was right — Occurrence coverage provides confidence, flexibility and value.

1Confidence

Will your professional liability policy provide sufficient limits to protect you, your family and your estate during retirement and thereafter?

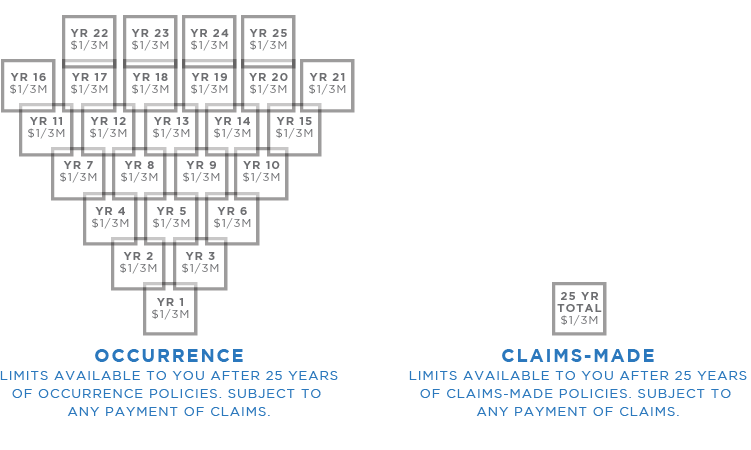

Occurrence coverage provides a separate set of limits for each year you buy the policy, with respect to alleged errors occurring during the policy period, regardless of when a claim is made against you. Occurrence coverage doesn't end when the policy terminates; instead, the limits under the policy remain available to pay future claims based upon incidents that occurred during that policy period. Contrast this with Claims-made coverage which only provides limits for claims made during the current policy year, so only the current set of limits is available to pay claims arising from all your previous years of practice. This important difference becomes more relevant as you near retirement.

Example:

Over the course of a 25-year career, a radiologist will read approximately 400,000 films — presenting 400,000 opportunities for a patient to allege malpractice. Under a Claims-made tail endorsement with a standard $1M/$3M limit, there is only $1M available to pay any single claim, and only $3M total to pay all claims arising during the life of the tail coverage. This means that with Claims-made coverage, the radiologist will have only one set of limits ($1M/$3M) to pay all potential professional liability lawsuits over an entire 25 year career. In contrast, if the same doctor had purchased Occurrence coverage each year for the same 25 year period, he or she would have potentially 25 times the coverage. Greater limits.

That's real confidence.

2Flexibility

Given today's changing healthcare landscape, can you predict what malpractice coverage needs you will have in the future? With Occurrence coverage, you need not worry about securing tail coverage for any change in your life or practice.

Examples:

- A solo anesthesiologist is considering selling his practice to a local hospital. Fortunately, he purchased Occurrence coverage for the past 12 years. As a result, he does not need to include the cost of tail coverage when negotiating the sale price of his practice.

- A multi-specialty group is hiring a new physician; however, the group is not certain whether they'll need the position in a few years or whether the physician candidate will be the right fit. By purchasing Occurrence coverage for the new physician, the group eliminates the awkward discussion about the expense of tail coverage if and when the newly hired physician leaves the practice.

- A female dentist, after practicing six years, decides to start a family and take the next few years off work. Unfortunately, her coverage for those six years was Claims-made; therefore, she must purchase costly tail coverage when she leaves the practice to start her family. Many other types of leaves of absence present the same challenge. She would not have the expense of tail coverage had she purchased Occurrence coverage during the past six years.

- A self-employed nurse practitioner with Claims-made coverage relocates to another state in order to be closer to her family. Unfortunately, the group she joins is insured by a carrier that operates in only one state. This carrier cannot accept her prior, out-of-state exposure because the carrier is not licensed and admitted in her prior state of practice. As a result, she will have to purchase tail coverage from her current carrier.

Occurrence coverage removes all barriers so you can practice how you choose, where you choose and for how long you choose.

That's real flexibility.

3Value

Given these significant benefits, would you guess Occurrence coverage is more expensive than Claims-made?

It's not. In fact, once cost for tail coverage is included, Occurrence is oftentimes less expensive than Claims-made coverage.

| Remainder of State, KY Internal Medicine (No Surgery) $1/3M | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Imagine: more comprehensive coverage for less cost. That's real value.

Wonder why all carriers don't offer Occurrence?So how do you decide?