The Benefits

Many dentists and oral surgeons today are realizing that the small group of doctors in 1899 was right — occurrence coverage provides confidence, flexibility and value.

1Confidence

Will your healthcare malpractice policy provide sufficient limits to protect you, your family and your estate during retirement and thereafter?

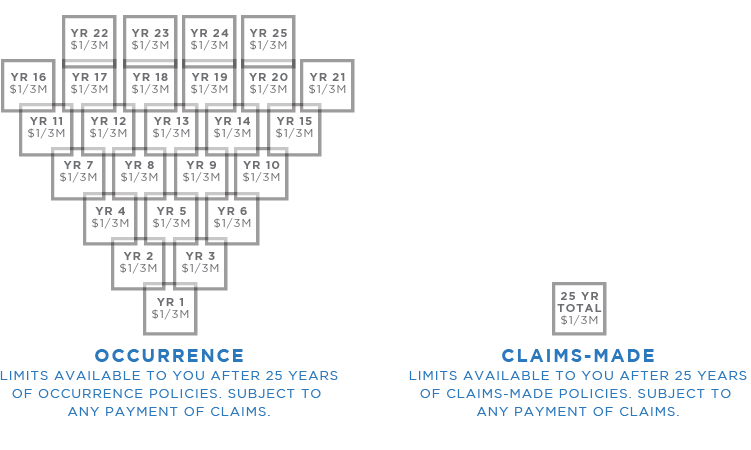

Occurrence coverage provides a separate set of limits for each year you buy the policy, with respect to alleged errors occurring during the policy period, regardless of when a claim is made against you. Occurrence coverage doesn't end when the policy terminates; instead, the limits under the policy remain available to pay future claims based upon incidents that occurred during that policy period. Contrast this with claims-made coverage, which only provides limits for claims made during the current policy year, so only the current set of limits is available to pay claims arising from all your previous years of practice. This important difference becomes more relevant as you near retirement.

Example:

Over the course of a 35 year career, a dentist will see approximately 129,000 patients—presenting 129,000 opportunities for a patient to allege malpractice. Under a claims-made tail endorsement with a standard $1M / $3M limit, there is only $1M available to pay any single claim, and only $3M total to pay all claims arising during the life of the tail coverage. This means, with claims-made coverage, the dentist will have only one set of limits ($1M / $3M) to pay all potential healthcare malpractice lawsuits over an entire 35 year career.

In contrast, if the same dentist had purchased occurrence coverage each year for the same 35 year period, he/she would have potentially 35 times the coverage.

Greater limits. That's real confidence.

2Flexibility

Given today's changing healthcare landscape, can you predict what malpractice coverage needs you will have in the future? With occurrence coverage, you need not worry about securing tail coverage for any change in your life or practice.

Examples:

- An older dentist is considering selling his practice to a newly graduated dentist. Fortunately, he had purchased occurrence coverage for the past twelve years. As a result, he does not need to include the cost of tail coverage when negotiating the sale price of his practice.

- A multi-specialty group is hiring a new dentist anesthesiologist; however the group is not certain whether they'll need the position in a few years or whether the dentist anesthesiologist candidate will be the right fit. By purchasing occurrence coverage for the new addition, the group eliminates the awkward discussion about the expense of tail coverage if and when the newly hired dentist anesthesiologist leaves the practice.

- A dentist, after practicing six years, decides to start a family and take the next few years off work. Unfortunately, her coverage during those six years was claims-made; therefore she must purchase costly tail coverage when she leaves the practice to start her family. Many other types of leaves of absence present the same challenge. She would not have the tail coverage expense had she purchased occurrence...

-

An oral surgeon with claims-made coverage relocates to another state in order to be closer to family. Unfortunately, the group he joins is insured by a carrier that only operates in a few states.

This carrier cannot accept his prior, out-of-state exposure because the carrier is not licensed and admitted in his prior state of practice. As a result, he will have to purchase tail coverage from his current carrier.

Occurrence coverage removes all barriers so you can practice how you choose, where you choose and for how long you choose.

That's real flexibility.

3Value

Given these significant benefits, would you guess occurrence coverage is more expensive than claims-made?

It's not. In fact, once cost for tail coverage is included, occurrence is oftentimes less expensive than claims-made coverage.

| Amarillo, Texas (Randall County), General Dentist (No Surgery) $1M / $3M | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

*Available only with ASDA discount |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amarillo, TX (Randall County) Oral and Maxillofacial Surgeon $1M / $3M | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

*Available only with ASDA discount |

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Imagine: more comprehensive coverage for less cost. That's real value.

Wonder why all carriers don't offer occurrence?So how do you decide?