Understanding Coverage Type

Occurrence

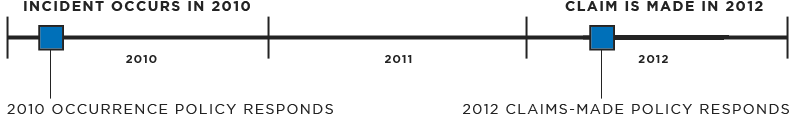

Occurrence coverage responds to a claim based on when the dental treatment occurred, regardless of when the claim is actually made against you. As long as the incident occurred during the policy period, your occurrence policy will respond according to the terms and conditions of the policy — even if the claim is made after the policy period expires. For example, if a claim is made in 2012 based on treatment rendered in 2010, the 2010 occurrence policy responds.Claims-Made

Claims-made coverage, by contrast, responds to claims based on when the claim is made against an insured. For example, if a claim is made in 2012, based on treatment rendered in 2010, the 2012 claims-made policy responds, as long as the incident occurred after the policy's retroactive date. The policy's retroactive date is the date after which treatment must occur to trigger coverage.

Though the above distinction might seem like an insurance technicality, the reality is that selecting your policy type is one of the most significant decisions you'll make when buying professional liability coverage for two reasons:

Limits: With occurrence coverage, you receive a separate set of limits every year you have the coverage. Also, occurrence policy limits remain in place after the end of the policy period to pay claims arising from incidents occurring during the policy period. In contrast, with claims-made coverage, only the then-current policy limits are available to pay claims made during the policy period, which can result in faster exhaustion of limits if many claims are filed in the same policy period.

"Tail" Coverage: Because claims-made policies do not cover claims made after the termination of the policy, you must secure "tail" coverage (an extended reporting endorsement) at the termination of the policy. This can happen in many situations such as leaving practice, taking a significant amount of time off, entering a practice that requires you to join a group policy, or moving to a state that will not cover your practice from the prior state. Tail coverage is generally expensive, and some companies will provide free tail coverage in the event of death, disability, or retirement. Occurrence policies do not require tail coverage.